"Nothing is more powerful than an idea whose time has come."

Alternate Website Access:

Dennis Thornton Alleges Whitefish Credit Union Stole Property Valued at $110 Million

Whitefish Credit Union crime victim, Dennis Thornton, filed a report with the Flathead County Sheriff regarding the theft of over $110 Million in property by Whitefish Credit Union and their agents. He says there are "several other victims" that he knows of and that "we can't allow this to happen in our community."

Share (Alt) Montana 1, Montana 2, Montana 3, Montana 4, Montana 5

8-19-2021.

Theft report filed with the Flathead County Sheriff's Office.

Incident Number: CR2021-30528

Attention: Sheriff Brian Heino

Attention : Cpl. Westfall

Sent to Rep. Derek Skees

Sent to Rep, Mark Noland (Bank Oversight Committee )

Sent to Sen. Mark Blasdel

Gentlemen,

I Dennis Thornton, president of Thorco Inc. submit the following theft complaint on behalf of myself and wife Donna and as president of Thorco lnc.

I swear under the penalty of perjury that the following statements are true and correct to the best of my knowledge.

On October 25,201,8 Whitefish Credit Union hereafter (WCU)'s attorney Sean Frampton electronically transfered the ownership of 74 tracts of land totaling 500 acres from the ownership of Thorco Inc. into the ownership of Whitefish Credit Union using invalid deeds.

The deeds came from a June 8, 2016 settlement agreement that was to be, but never became part of the litigation and title chain.

Dennis and Donna Thornton and Thorco Inc. was instructed by counsel to sign the settlement agreement and deliver the settlement agreement to WCU's counsel Sean Frampton so that WCU's required signatures could be added so that the escrow required in the agreement could be opened at First American Title Company.

Under the Montana Mortgage Act only a licensed individual can open escrows or record documents that involve credit union business.

The terms of the settlement agreement were never completed, recorded, approved by or reserved by the court.

WCU never delivered the documents to First American Title Company.

The deeds in the settlement agreement were given for security. They were not deeds in lieu, deeds in lieu must be transferable on the date given all others are considered security deeds. Security deeds create a mortgage. All realestate transactions are required to be recorded, including mortgages.

WCU was in custody and control of all documents after June 8, 2016 and was responsible for complying with the Montana Mortgage Act, lf the agreement were to go into effect.

MCA 71-1-?02. Mortgage not considered conveyance -- recovery of possession. A mortgage of real property shall not be deemed a conveyance, whatever its terms, so as to enable the owner of the mortgage to recover possession of the real property without a foreclosure and sale. When the mortgage confers a power of sale. as mentioned in 71-1-111, possession may be recovered according to the terms of the mortgage.

WCU stripped the deeds from the settlement agreement and that transferred the ownership. With no court order to do so.

WCU after transferring the ownership of the property, cut the locks off of Thorco Inc.'s gates, depriving Thorco Inc. access to more than 30 pieces of heavy equipment for almost three years.

Thorco Inc., has plenty of documentation to show that WCU's attorney Sean Frampton and WCU SAG agent Aaron Archer conspired to steal Thorco lnc.'s, 24 tracts of Iand totaling 500 acres and did so on October 25, 2018.

Sean Frampton knew the deeds used to transfer the ownership were invalid. Frampton is a licensed attorney and practices in real estate and banking transactions, Frampton knew at the time that the terms of the settlement agreement were not adhered to. Not recorded or approved by the court.

On August 12,20L6, WCU through attorney Sean Frampton drafted and filed a joint motion in DV-12-1748 vacating a February 23,2016 judgment in the amount of $4,348,880, in favor of WCU. This forever satisfied and concluded WCU's judgment of $4,348,880.

On August 24,201,6, all litigation was concluded . WCU through attorney Sean Frampton drafted and filed a joint motion in DV-I2-I748 dismissing with prejudice WCU's foreclosure action and Thorco Inc.'s counterclaim. There is no judgment reinstating the original 2009 mortgage contract.

The dismissal with prejudice, judgment has no reservations and is the controlling document.

WCU is barred by preclusion, Res Judicata, and by Montana Code 71-1-222. Proceedings in foreclosure suits. (1) There is only one action for the recovery of debt or the enforcement of any right secured by a mortgage upon real estate, and that action must be in accordance with the provisions of this part.

Montana Supreme Court Rulings

State v. Twelfth Judicial District

"The term 'with prejudice' as used in a judgmcnt of dismissal has a vvell-recognized legal irnport. It is the converse of the term 'without prejudice'. and a judgment or decree of dismissal with prejudice is as conclusive of the rights of the parties as if the suit had been prosecuted to a final adjudication adverse to the plaintiff."

Therefore, a stipulation of dismissal with prejudice of a defendant is tantamount to a judgment on the merits; and accordingly, such a dismissal with prejudice is res judicata as to every issue reasonably raised by the pleadings. Under the doctrine of respondeat superior, an employer defendant's liability is vicarious or derivative and does not arise until an employee acts negligently within the scope of his employment. Under the doctrine of respondeat superior, such a dismissal of an employee operates to exonerate the employer. This Court will look at the dismissal with prejudice on its face, and will not look behind the words "with prejudice."

First Bank Missoula v. District Court

"Once there has been full opportunity to present an issue for judicial decision in a given proceeding...the determination of the court in that proceeding must ve accorded finality as to all issues raised or which fairly could hae been raised, else judgments might be attacked piecemeal and without end. (Citation omitted )"

Wellman,198 Mont. at 45-46, 643 P.2d at 575. See Brault v. Smith (Mont. 1984) [209 Mont. 21] 679 P. 2d 236, 41 St. Rep 527

The Stotts were given the opportunity to litigate the issues raised in their complaint, but agreed to stipulate for a dismissal with prejudice. The effect of a stipulation is the same as a judgment on the merits. Accordingly, a dismissal with prejudice is res judicata as to every issue raised in the pleadings. City of Havre v. District Court (1980), 187 Mont. 181, 609 P. 2d 275; cert. denied Boucher v. City of Havre (1980),449 U.S. 875. l0l S Ct. 219, 66 L.Ed.d.2d 97;Schillinger v. Brewer (Mont. 1985), [215 Mont. 333,] 697 P.2d 919, 42 St.Rep. 408.

WCU sent Thorco lnc., an acceleration notice which starts the foreclosure process and aggregates all payments and interest into one amount due. WCU then sued to foreclose on that amount, WCU received a judgment in the amount of $4,348,880. The Montana Supreme Court ruled it was not a final judgment and could not be a final judgment until Thorco lnc.'s counterclaims were adjudicated. WCU then vacated the judgment on August 12,2016 by a joint motion drafted by Sean Frampton. WCU then dismissed WCU's foreclosure lawsuit DV-12-1748 by joint motion drafted by Sean Frampton

As you can see above, WCU has no legal claim or right to state that Dennis and Donna Thornton or Thorco Inc. owes $4,348,880. Any claim by WCU is a false claim and a financial crime.

WCU through attorney Sean Frampton and SAG agent Aaron Archer still continued to state, Dennis and Donna Thornton and Thorco Inc. still owe $4,348,880. This is documented in court proceedings and affidavits.

It was first discovered on or about November 27,2017 (when Thorco lnc. had an aggregated amount of over $14 million to complete the payment portion of the settlement) through a title report prepared by Alliance Title that WCU had not completed its portion of the settlement agreement and that First American Title Company had no record of any escrow agreement as one of the terms and conditions required to complete the terms of the settlement agreement. Flathead County Clerk and Recorder's office had no record of a mortgage satisfaction (UCC 3. Termination Statement) that is required once a mortgage is satisfied or discharged

MCA 71-1-211. Satisfaction of mortgage -- record thereof. (1) A mortgage must be discharged upon the record by the county clerk in whose custody it is recorded whenever there is presented to the clerk a certificate executed by the mortgagee or the mortgagee's personal representative or assignee. acknowledged or proved and certified as prescribed in this chaprer that entitles a conveyance to be recorded, specifying that the mortgage has been paid or otherwise satisfied or discharged.

(2) Every certificate and the proof and acknowledgment must be recorded at full length. and a reference must be made to the book and page containing the record in the mortgagor and mortgagee indexes as to the discharge of the mortgage.

Once it was discovered through the title report provided by Alliance Title and that First American Title Company had no record of the settlement agreement or an open escrow account Dennis Thornton contacted Thorco lnc's. Counsel John Amsden. Amsden's office notified WCU of the cloud on the title and that the escrow had not been opened. WCU refused to open the escrow at First American Title Company or released the cloud on the title.

Thorco lnc. having funding available on or about December 1,2017 Dennis Thornton offered payment of $1,400,000 to First American Title Company, the place of payment described in the settlement agreement, First American Title Company refused payment.

Although not legally required to pay WCU because, as stated above, the 2009 mortgage was discharged and no other mortgage was recorded, Thorco Inc. has documentation to show that multiple attempts have been made to WCU requesting WCU honor the settlement agreement, each and every time WCU has refused.

In December 2017, several attempts were made by Thorco's counsel to have WCU remove the 2009 mortgage from the public record and deliver the settlement agreement to First American Title Company as agreed and WCU refused. As stated above, WCU knew in August 2016 that WCU's foreclosure judgment was vacated and there foreclosure lawsuit was dismissed with prejudice WCU, instead made threats that WCU was going to use the deeds to transfer ownership, if payment of $1,400,000 was not made first, knowing fullwell that no title report would be able to be issued for S1,400,000 by any title company with a cloud on the title.

Because of WCU's threats Thorco Inc., filed for Chapter 11 bankruptcy protection. At the first creditors meeting Dennis Thornton requested WCU deliver the documents to First American Title Company so Thorco lnc., could make payment, WCU refused. In any bankruptcy action, creditors must file a proof of claim. WCU filed a proof of claim stating under the penalty of perjury that WCU had recorded mortgages in the amount of $1,400,000. A simple check with Flathead County Clerk and Recorder's Office will reveal that WCU does not have a recorded mortgages in the amount of $1,400,00O. This is fraud on the court, which is a crime.

The Bankruptcy action was later dismissed after an agreement was reached with WCU whereby WCU would deliver the documents to First American Title Company so that the escrow could be opened. As soon as the bankruptcy was dismissed, WCU went to First American Title Company and retrieve the documents, and then used the deeds transferring the ownership.

In 2019 Thorco Inc.'s, accountant Andrew Johnson, retired IRS fraud investigator, investigated WCU's actions and determined that Thorco Inc.'s, 2018 tax return could only be filed as a theft. The Montana Department of Revenue and the lRS have determined the tax return has been filed correctly.

This resulted ln a loss of over 55 million in taxable revenue to the state of Montana and lRS, but that's not the only loss that will occur to the State of Montana and the lRS. Thorco Inc. has until September 15 to amend the 2018 tax return to reflect the actual cash value of the property and equipment that has been stolen, or amend the return showing the property has been restored to Thorco Inc.. The amended tax return will be in excess of $100 million if the property is not returned on or before September 15, 2021, the amendment will be final and not reversible.

Dennis and Donna Thornton and Thorco Inc. have been working with expert witnesses investigating WCU's actions. All investigators concluded WCU's conspired to steal Thorco Inc.'s property

Thorco Inc. has documentation obtained through a deposition prepared by James Manley (now the Hon. James Manley) that shows starting as early as August 2010 that WCU loan officer Randy Cogdill was showing the property to other developers and attempting to sell the property almost eight months before the original mortgage with WCU was even due. This is been an ongoing attempt for almost 11 years.

Thorco Inc. has documentation that shows WCU conspired with appraiser Lloyd Barrie and interfered with an appraisal contract already entered into between Thorco Inc. and Barrie Appraisal Services. WCU change the foreclosure instructions to undervalue Thorco Inc.'s property so that Thorco Inc. did not qualify for refinancing, at the same time leading Thorco Inc. past the loan maturity date, by not responding and then by agreeing to refinance. This was an engineered foreclosure in an attempt to steal the property.

WCU use the undervalued appraisal, approximately $1,700,000, as a reason for not refinancing, WCU then foreclosed. Thorco Inc. filed for Chapter 11 bankruptcy protection. WCU then filed a proof of claim, claiming the amount of the property was $8,790,000 and that Thorco Inc. was an over secured creditor and that WCU should be entitled to interest and attorney fees post-petition.

The bankruptcy was dismissed and the case was remanded back to the District Court. District Court Judge Robert Allison ruled that at least $26 million in the appraisal prepared by Roy Nicolette was relevant in Thorco Inc.'s $60 Million counterclaim.

Thorco Inc. has documentation to show that WCU was requesting documents for a refinance and at the exact same time was working with their attorney Ryan Purdy to foreclose on Thorco Inc.

Thorco Inc. has documentation that shows Thorco Inc. borrowed millions of dollars and repaid every loan as agreed without a single blemish, and because of Dun & Bradstreet audit and Thorco Inc. repayment history received a $20 million bonding line from Western Surety more than 20 years ago. At the time this was one of the largest bonding lines in the state of Montana.

Thorco Inc. has documentation that shows shortly after Thorco Inc's 2009 mortgage with WCU that WCU was barred from making any loans. WCU did not notify any of the borrowers that WCU was barred from making loans. Had WCU notified Thorco Inc., Thorco Inc. could have refinanced just about anywhere, but instead WCU engineered a foreclosure by intentionally leading Thorco Inc. past the maturity date. Once a loan is past the maturity date, it is in default and refinancing is almost impossible. WCU is a sophisticated lender and knew exactly what they were doing. This was their first attempt to steal the property.

WCU knowing that Thorco Inc. was going to be able to prove that Thorco Inc. qualified for the second phase of funding or could have refinanced just about anywhere and was going to be able to show that WCU engineered a foreclosure took a different tactic to steal the property.

WCU entered into an agreement through first Settlement Term Sheet and then a Settlement Agreement and Mutual Release that by all actions of WCU show that WCU never intended to honor. The intent of the settlement agreement was to obtain Deeds so that WCU could transfer ownership to complete the theft.

The settlement agreement was drafted by Sean Frampton. It is clear to see that this settlement agreement was drafted in such a way that Thorco Inc. would never be able to perform on, if WCU never removed its original mortgage, never recorded the new mortgage, never opened the escrow and then simply told anyone inquiring that Thorco Inc. was in foreclosure and that WCU had a judgment for more than $4.5 million. Thorco Inc. has documentation to show that WCU did exactly that. The settlement agreement can be viewed as nothing more than as stated in the Montana code 70-20-401. instrument made with intent to defraud--void.

Thorco Inc. can show that WCU derailed several of Thorco Inc.'s financial transactions, but despite WCU's actions Thorco Inc. still had funding available to complete the terms of the settlement agreement, but was prevented because of the cloud on the title. No lender or investor was willing to move forward until a clear title report could be issued.

Thorco Inc. received documentation from the Flathead County Planning Office that shows WCU has been working with a land planner to further develop the property stolen from Thorco Inc. This Should Be Clear And Convincing Evidence of what WCU's motives truly are.

Thorco Inc. also has documentation that shows WCU has been foreclosing on other borrowers' properties and selling the properties at a profit. This also should be clear and convincing evidence of what WCU's motives truly are.

Thorco Inc. is in receipt of an affidavit of Aaron Archer prepared by Sean Frampton on August 31, 2018 and submitted to the Hon. Dan Wilson in DV-18-336D stating Thorco Inc. still owes over $4 million, who both knew this was a false statement. This is also fraud on the court and a financial crime.

Thorco Inc. has documentation that show WCU committed fraud on the courts to obtain judments or favorable rulings.

This is just a brief summary outlining some of the crimes and is not intended to be a complete complaint. Only some documentation will be provided at this time so as not to overwhelm the investigator. Thorco Inc. and its investigators request a formal face-to-face meeting with the investigator assigned.

Any investigator should be able to quickly determine that the 2009 mortgage was satisfied and discharged on August 24, 2016.

Any investigator should be able to quickly determine that WCU never filed a mortgage satisfaction as required under the Montana Mortgage Act.

Any investigator should be able to quickly determine that WCU never recorded anything giving WCU any security interest in any property belonging to Thorco Inc. after August 24, 2016.

Any investigator should be able to quickly determine the deeds used to steal Thorco Inc.'s equipment and real property are invalid.

Any investigator should be able to quickly determine from WCU's actions what the true motive was.

If the Flathead County Sheriff's Office feels it does not have the resources or the expertise to investigate these crimes, Thorco Inc. will pay for a mortgage fraud and forensic analysis.

Thorco Inc. has been in contact with Marie McDonnell, Pres. and CEO of Mortgage Fraud and Forensic Analyst. Marie is a Certified Fraud Examiner (CFE) and also a Master Analys in Financial Forensics (MAFF) Marie has been sent enough documentation that she believes she would have no problem writing the criminal complaint. Marie has done this before and as stated that what is required is a public-private partnership granting investigative powers.

Thorco Inc. request first that Thorco Inc.'s shareholders be allowed with the aid of the Flathead County Sheriff's Office to cut the locks off of the gates to be able to obtain access to inspect and inventory the equipment and supplies on the property.

Thorco Inc. request second that if Flathead County Sheriff's Office does not believe there is a financial crime or the theft of the property show with 100% certainty why not.

Let this complaint serve as authorization to access any financial documents in custody and control of Whitefish Credit Union that involve Dennis and Donna Thornton or Thorco Inc.

Let this complaint serve as a 100% release of liability for any public dissemination of any financial document involving Dennis and Donna Thornton or Thorco Inc.

We look forward to your assistance and hope that this can be resolved quickly because this has left Thorco Inc. Dennis and Donna Thornton in legal and financial limbo for almost 3 years

Respectfully Submitted on This Date 8-19-2021

By Dennis Thornton, President of Thorco Inc.,

Bigfork Representative, Mark Noland, Goes on the Record Alleging Unlawful Conduct by Montana's Largest Credit Union

On September 7th, Representative Mark Noland filed a letter into the record of the United States Bankruptcy Court, In re: Thorco Inc, Case No. 22-90119-BPH alleging that Whitefish Credit Union did not lawfully come under the possession of the 500 acres under dispute.

The letter is attached below.

This story was originally published by Northwest Liberty News, here.

Newest Updates

For newest updates to this controversy go to https://montanadailygazette.com/whitefish-credit-union-investigation/

Camp Justice- Road To Victory Celebration

Please bring your family and friends along with empty stomachs to the following event on Saturday!

Montana Man Reclaims Stolen Bank Property; Establishes “Camp Justice” to Expose Crimes-ATTENDANCE NEEDED!

ATTENTION: CALLING ALL PATRIOTS! ASKING ALL WHO ARE ABLE TO GO TO 860 Boon Road in Somers, MT IMMEDIATELY! 860 Boon Road

Dennis Thornton, the Montana man who had his property stolen by Whitefish Credit Union (WFCU) in an illegal deed transfer, has taken matters into his own hands and reclaimed his property after exhausting all forms of legal process and procedure to receive justice.

Thornton, whose evidence was highlighted extensively in this article published a few months ago, is receiving media support from Montana Daily Gazette and logistical support from People's Rights, the group founded by activist and Idaho gubernatorial candidate, Ammon Bundy.

One of the elements of the Thornton case that piqued the interest of the Montana Daily Gazette is the fact that Thornton is not alone in his assertions that WFCU stole property from him, as Montana Daily Gazette has spoken to more than a half-dozen people who allege similar crimes committed against them by WFCU, all of which can be viewed on the Montana Gazette Radio Rumble channel by clicking here.

It should also be noted that several currently serving, high-ranking legislators have reviewed the evidence against WFCU and also believe that there was potential criminal activity, including Mark Noland who is the head of the Montana Banking Oversight Committee.

From observations and conversations with the patriots who have already arrived at Camp Justice, these men and women are in for the long haul. If you are close to Montana's Flathead Valley and wish to participate in the liberation of Dennis Thornton's property, you can come to 860 Boon Road in Somers to show your support.

We need to have you there!

(This article was first published at Montana Daily Gazette by Editor James White.

Dennis Thornton Reclaims Stolen Property

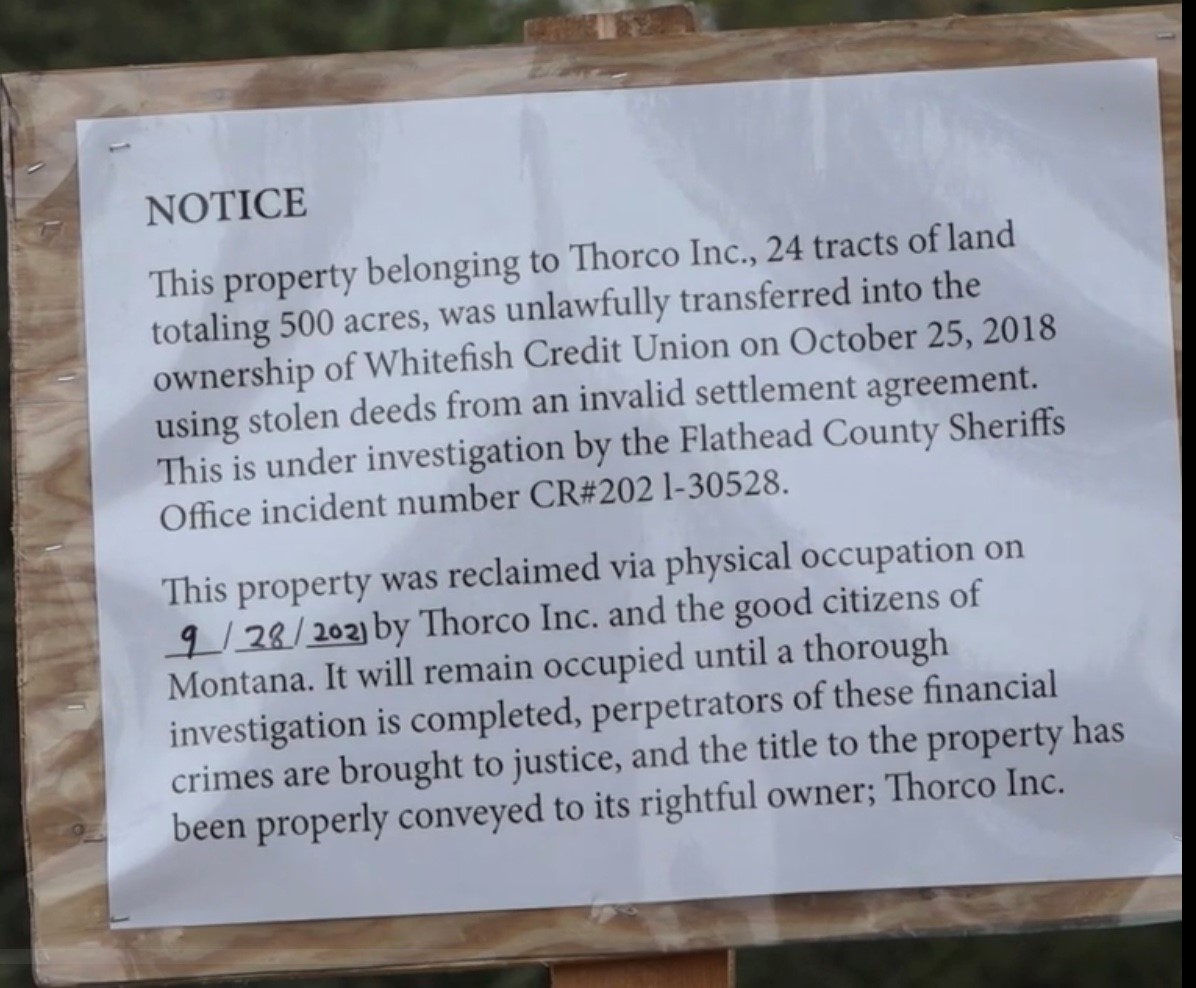

On Sept. 28, 2021, Thorco Inc. and the good citizens of Montana reclaimed 24 tracts of land totaling 500 acres that Whitefish Credit Union had stolen by transferring the title on security deeds from an invalid settlement agreement that never went into effect.

Dennis' story can further be heard in the following (2) videos:

Report Drafted By Geodetic Consultant Draws Conclusions Of Unlawful Conveyance

In the attached report signed on Aug. 9, 2021 geodetic consultant, Rick Breckenridge, gives the following reasons as to why he believes the Title to Thorco Inc.'s property was unlawfully conveyed:

1. Deeds filed by WCU were stolen from an agreement that never went into effect.

2. Deeds filed by WCu reference a lien that was satisfied by the Stipulation to Dismiss with prejudice order.

3. Judge Dan Wilson ordered the removal of records from the chain of title that clearly and without any ambiguity, showed that the WCU 2009 mortgage was satisfied.

Lastly, Breckenridge points out that "Judge Allison further muddied the waters by forbidding the only people who have an interest in clearing the title from recording any documentation that would clear the cloud."